A “rule of thumb” is a mental shortcut people use when making decisions. It isn’t always accurate, but it is easy to learn and easy to apply. This is usually a good thing, as it allows people to make quick decisions. But rules of thumb aren’t the same as a fundamental law, and can break down under unusual circumstances.

As an example, one rule of thumb is “what goes up must come down”. For 10,000 years of human history, this rule of thumb was 100% accurate. If Samson himself threw a rock into the air, it would eventually come down. An accurate rule of thumb, but not an ironclad law. The ironclad law (Newton’s theory of gravity) says that if the speed of the rock is faster than escape velocity (7 miles per second), it will fly away and never come back down. We have several spacecraft leaving the solar system which attest that that rule of thumb breaks down under certain circumstances.

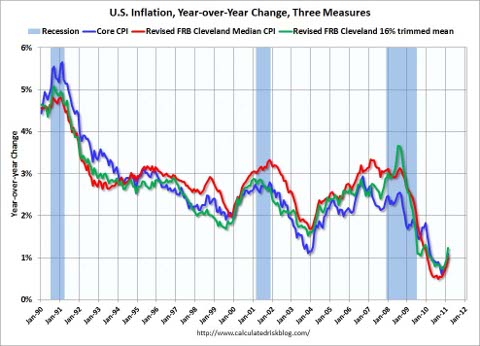

Austerity supporters won this election cycle by promising, among other things, to rein in government spending on the theory that since individuals are tightening their budgets, the federal government must do the same. This is another rule of thumb, which is accurate most of the time, but *not* in rare instances when the economy is against the zero bound and deflation is setting in (like the Great Depression, and like right now).

The laws of macroeconomics say a couple of things:

- Personal savings + personal consumption = Personal income

(ie, you can choose to either spend or save your money, but the total is limited by how much you make a year)

- World consumption = world income

(there is no savings for the world as a whole. Some people save money (the Chinese), but their savings gets funnelled to people in other countries (the USA) to fuel consumption, and the total saved is zero.

Combine those two laws and you get a 3rd law:

- World consumption by debtors + world consumption by creditors = world income.

In a depression, debtors want to reduce their consumption so they can pay off their debts. To keep the equation balanced, one of two things must happen:

A) creditors must *increase* consumption by as much as debtors decrease.

B) world income must *decrease* by as much as debtors decrease

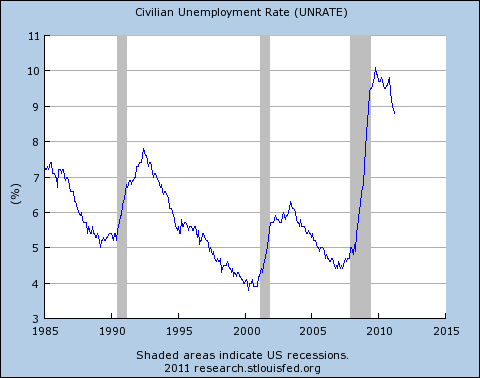

No one in their right mind wants option B. That is how debt-deflation spirals set in, which are cruel destroyers of wealth. People start delaying purchases because they know that deflation will make prices cheaper in the future. Incomes drop, and since people now have even less money they start waiting longer, which makes incomes drop further. The cycle repeats and destroys a lot of wealth before the cycle burns itself out. Read the history of the Great Depression for a hint of how corrosive this can be.

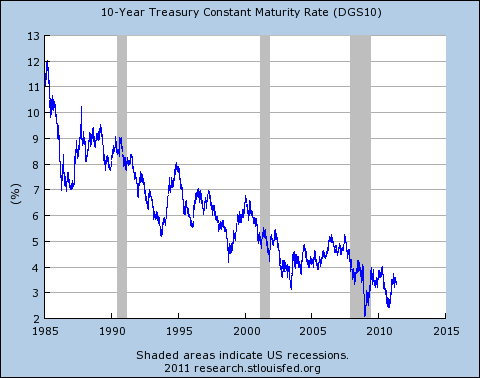

So our least worst option is option A. But herein lies another problem: the Federal government doesn’t have a good way to induce creditors to spend more money when the economy is against the zero bound (ie, when the Federal reserve rate is at 0%).

Businesses choose to make investments based on the expected rate of return. If an investment costs 5% but is expected to return 10%, then the business will make that investment because the return is greater than the cost. In real life, most investments are not this clear. There is always uncertainty in how much money you will make off an investment. If the return is sufficiently low (3-4%), then businesses will not make those investments because the size of the uncertainty (and therefore the odds of failure) dwarfs the potential profit.

One of the largest costs of an investment is the cost of borrowing debt to fund it. In a regular recession, the Fed can reduce that cost significantly by lowering the Federal rate a few points. Suddenly, a lot of marginal investments that have uncertain outcomes become much more likely to see a profit, and businesses start pouring money into the economy, which helps drag it out of recession.

But you can’t lower the Fed rate below 0%, which is where we’re at now. Monetary policy is powerless at the zero bound. Since monetary policy doesn’t work, the only tool the government has left to balance our equation is fiscal policy (ie, stimulus or deficit spending). The government is trying to compensate for the drop in consumer spending to prevent incomes from going down.

This is where austerity supporters are going to cause us severe pain if they insist on getting their way. If they take away the government’s ability to use deficit spending to prop up the economy (and thus our incomes), then the result is going to be falling incomes for both debtors and creditors. The equations don’t care if you’re a good person or a bad person, whether you saved your money wisely, or spent it on McMansions and flat screens. Everyone will suffer. We have historical proof of this too. Austerity supporters caused the recession of 1937 by trying to cut spending during the Great Depression before the economy could improve enough to support it.

Please don’t misunderstand me. I hate that we’re in this position. I hate that our government has to use deficit spending. I’m not saying it’s a wonderful thing, because it isn’t. But it *is* the least worst alternative we have left to us. And I am honestly afraid that austerity supporters, though well-meaning, will apply a rule of thumb to a situation where it doesn’t apply, and make things *much* worse.