I have been trying for over a decade to get broadband Internet for my parents, who live a mile off Bearwallow Rd. in a deep valley (the picture at the top is their driveway right before you go off the hill). Thus far…

- No DSL. AT&T has a cluster of cabinets 1 mile from their driveway, but doesn’t offer DSL from them. The cabinets on either side of our cabinet (at the intersection of Bearwallow Rd. and Highway 49, and at the intersection of Bearwallow Rd. and Bandy Rd.) both have high-speed U-Verse DSL, so they have the necessary fiber to support DSL in our area, but are intentionally skipping it.

- No Fiber. I have asked Charter if they could provision single-mode fiber if I pulled it all the way to the road myself. No. First, they have “no plans to develop” our neighborhood (despite the fact that I can *see* their cable on the pole) and we would have to pay $15k just to set up a new node. Second, they can only provision fiber they lay themselves, which costs $5-7k more than doing it myself. Which is hard on retired fixed-income folks.

- No cable. Their house doesn’t have cable coax. See above for Charter’s idea of a reasonable price.

- No cell. The valley effectively blocks all signals. I have maps of every cell tower in a 10 mile radius, and never gotten a useful signal from any of them.

- No satellite. They don’t have line-of-sight with geosynchronous orbit, and even if they did, the satellite providers in our area aren’t accepting new customers right now.

- No ISDN. Not broadband (only 128k), but superior to the 22k dial-up they have. A year or two ago Tennessee decided it no longer had to be a tariffed service, and AT&T burned their ships behind them as rapidly as possible, because I was told the phone company’s local central office no longer has ISDN hardware.

At this point there’s nothing else I can do except bang my head against the wall.

Freshman economics tells you that some businesses don’t obey the usual free-market rules that apply to apples and iPod’s, and need to be regulated. These businesses are called “natural monopolies”, which is why natural gas, electricity, sewage, and roads are provided by either regulated public or private utilities.

A utility only needs one set of physical plant, one set of staff, one set of senior management. Multiple companies waste megabucks on multiple plant/staff/management. They waste further megabucks on advertising, trying to steal profitable customers from each other in a zero-sum game. There are several other types of market failure endemic to natural monopolies. These costs raise the necessary rate of return before Big Internet (AT&T/Comcast/Charter) will provide internet, and ends up marooning a lot of marginal households on the wrong side of the digital divide.

In the middle 2000’s several under-served TN cities got tired of being ignored by Big Internet and were evaluating municipal internet as a way to provide broadband access to under-served areas. So were several electric utilities (including CEMC, our local utility).

Being greedy but not stupid, Big Internet fought back. They blatantly bribed our state politicians with $200k of “campaign donations” that year (up from $2k the previous year), and as a result politicians passed the “Competitive Cable and Video Services Act”, which greatly handicaps municipalities and utilities from providing broadband (existing utilities were grandfathered in), in the name of “encouraging competition”. Given the population of Tennessee, that works out to roughly 3 cents for every citizen tossed under the bus.

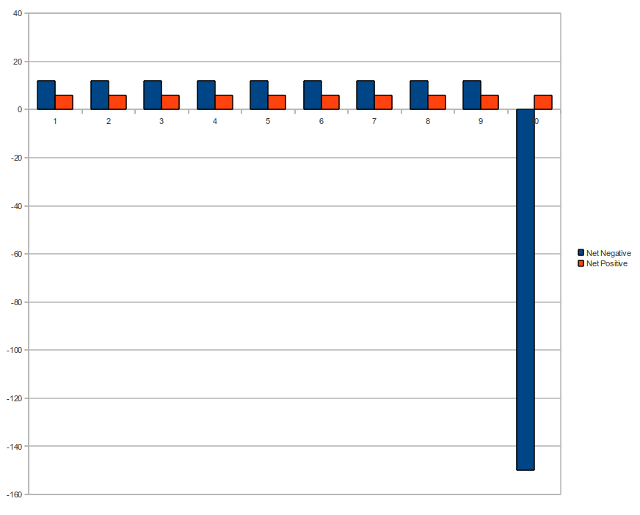

So what’s the net result of “encouraging competition”? 15% of the households in Cheatham County can’t get *any* broadband access. The rest pay prices for internet service that people in more advanced countries would consider a bad joke.

Big Internet’s stockholders only care about next quarter, not next decade. Today the real interest rate on 30 year US Treasuries is less than 1%. Internet providers that thought long-term would be backing up the truck, borrowing as much money as possible while it’s cheap, and making investments in fiber like there’s no tomorrow. But they’re not, because while it’s an excellent long-term investment, it requires a short-term hit to the stock price (and, because it is partly based on stock price, a short-term hit to senior management’s compensation). That short-term thinking is holding us all hostage.

By comparison, Chattanooga’s Electric Power Board has a monopoly on wired broadband in its service area. They have the fastest internet in the state, and one of the fastest on earth. Fiber everywhere. 1 Gbs (or 1000 Mbs) available today to every single home and business in their service area. No cherry-picking. Their *slowest* broadband connection (30 Mbs) is faster than Charter’s best in my neighborhood (25 Mbs), at 2/3’s the price. The other TN internet utilities that I know (Tullahoma Utilities Board, Jackson Energy Authority, Clarksville Department of Electricity) have lesser but still impressive results compared to our “competitive” ISP’s.

Our nation’s broadband situation is an utter embarrassment that can be laid directly at the feet of our politicians. The United States *invented* the Internet in the early 1960’s. This year we were ranked 35th in the world for broadband speed and availability, behind such economic titans as Bulgaria and Romania (which, by the way, treat broadband as utilities). Given the failure of competition to provide broadband, and the success of utilities, it’s rather obvious that broadband internet works best when it is a tariffed, regulated utility. We need to clear the existing legal hurdles passed in 2008 and allow our cities, counties, and electric utilities to enter the field.

Unemployment hovers around 9%, and underemployment around 16%. The long-term returns (both financial and social) of having broadband everywhere in this country far exceed the 1% borrowing costs. We should issue debt (which helps saves looking for safe places to save their money), put unemployed blue-collar people back to work (which both helps them and serves as economic stimulus), and build a fiber network to every house.

That could be done by the federal, state, or local government, or could be done simply by pointing the legal gun at the phone companies and compelling them to roll out the fiber network that we have already paid for several times over (roughly $200 billion in subsidies given to them explicitly for that purpose). Irrespective of how it’s achieved, it’s literally the biggest return-on-investment no-brainer I’ve ever seen in my life.

And for the record, I say all the above as someone who is not a hippy socialist, but a moderate Republican with a Vanderbilt MBA and a decade of experience in networking. Ideology and special interest need to rapidly start giving way to some pragmatism and hard facts, starting with the hard fact that we’re behind in the game and getting further behind every day.

DSL, cable modems, LTE, and other broadband methods prevalent in Cheatham County are at *best* stop-gap measures, and as bandwidth usage surges those methods will rapidly hit their scaling limits within a few years at most. Both DOCSIS 3 cable modems and vectored/bonded/phantom mode DSL scale to roughly 200-300 Mbs in lab conditions, and when they are finally available the median person in real-world conditions is unlikely to see much higher than 50-70 Mbs due to distance limitations (DSL) or number of subscribers per line (cable). For comparison, a single channel of Ultra-HDTV, due in 2018 currently requires 250 Mbs for streaming. Fiber networks can run 1 Gb (which is 1000 Mbs) today, 10 Gb next year, and can scale to at least 10,000 Gbs. It is as close to a future-proof technology as exists. I have little doubt my great-grandchildren will be using it, assuming we ever get around to building it.

Other cities (like Chattanooga) and other countries (like Europe and China) either have or are busy rolling out fiber networks like possessed madmen. They aren’t doing this out of the kindness of their heart, but out of competitive necessity. Broadband availability is the new electricity. You wouldn’t build a business (or a home for that matter) somewhere you couldn’t get electricity. Neither will they build where they can’t get broadband.

And areas that roll out fiber networks will get first-mover advantage both in creating new jobs, and attracting jobs from less provisioned areas. One day soon we won’t just be in danger of China, and India, and Latin America tempting away our manufacturing jobs, but also the high-end jobs like IT and healthcare.

Mathew Jason Binkley

Born and raised in Cheatham County, TN

Senior Systems Administrator

Advanced Computing Center for Research and Education

Vanderbilt University