Two months ago I wrote a blog post about where I thought the economy was heading. Since then, I’ve learned some things which suggest more pessimistic outcomes. I wanted to write them down, both for my memory and to inform others.

Assuming that a recession is headed this way, it would be quite helpful to be able to answer four basic questions:

- How big is the bubble?

- What pops the bubble?

- When does the bubble pop?

- How do we get back to normal?

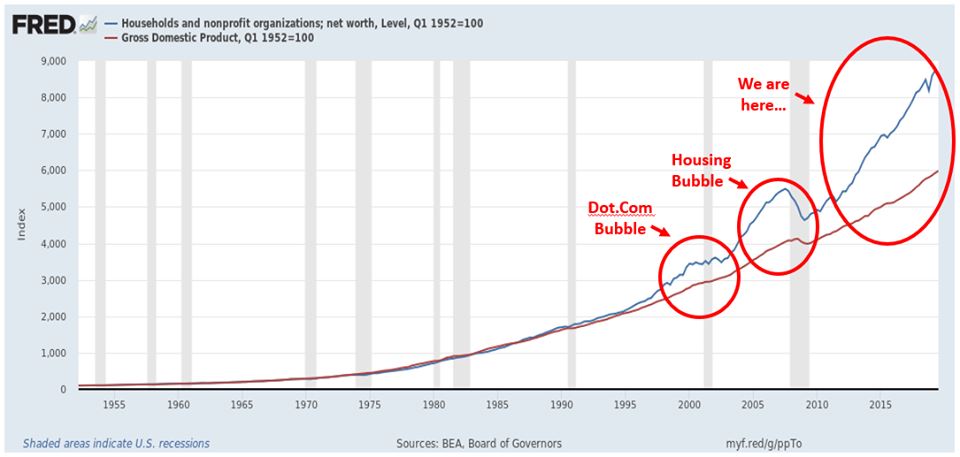

For #1, I recently learned a very useful measure to gauge the size of bubbles: Household Wealth vs GDP. Household wealth measures the value of everyone’s assets if they were sold at that instant at the current market price. For instance, if you owned 1,000 shares of Beenz.com, you might be a millionaire in 1999, or dead broke in 2002.

As a rule, household wealth shouldn’t grow any faster than GDP. It’s a way of saying “the sum of everyone’s individual wealth should grow at the same rate as the entire country’s wealth”. So when household wealth *does* grow faster than GDP, it indicates that asset prices are in a bubble.

So what does it look like today?

Ruh-roh…

In 2001, stock prices were inflated. In 2007, home prices were inflated. Today, it looks like *everything* is inflated. And the asset bubble is substantially bigger than the one that caused the Great Recession.

To put it delicately, this is unlikely to end well…

As for #2 (What pops the bubble), I have little new information on that, just various bits of speculation on my part. The bubble doesn’t have to *pop* per se. A “good” economic correction could slowly and safely let the air out and we could avoid serious problems (though a “good” correction would still feel painful, just less so). The best advice I can give you is still “whatever it is, don’t be around when it *does* pop”. And if Italy starts having financial problems, be *very* afraid.

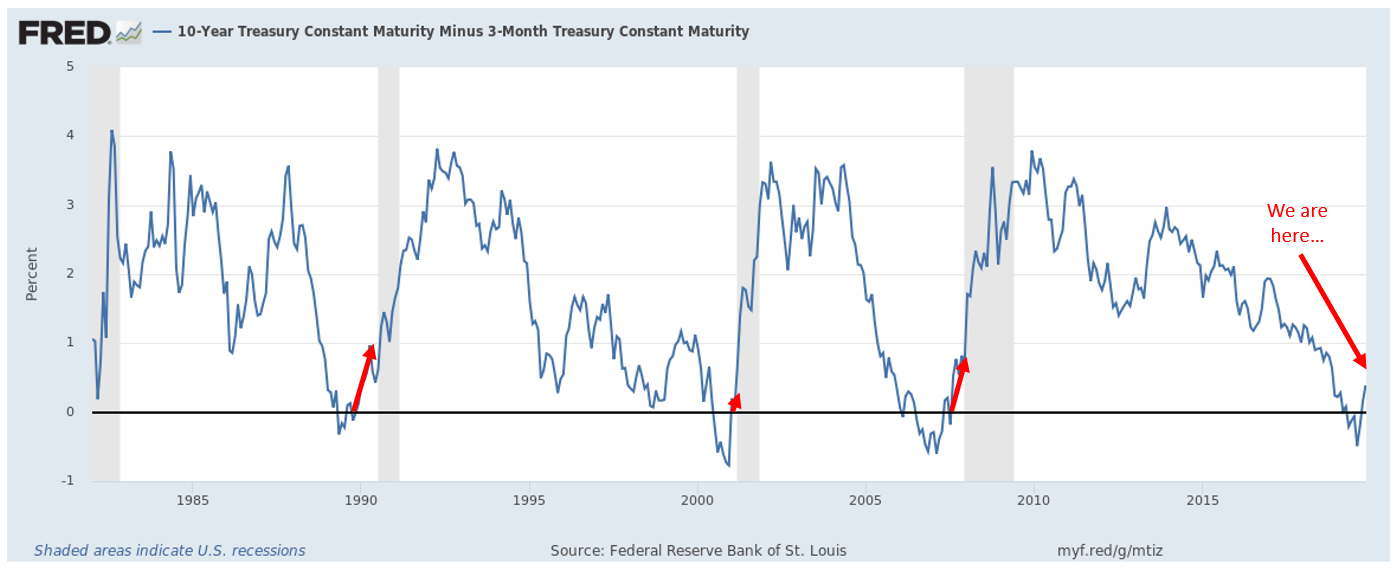

For #3, I mentioned last time about the yield curve, and how yield curve inversions predict recessions. Since then, the yield curve has reverted to normal. Isn’t that great?

Nope. It’s bearish, and a sign that a recession may be coming sooner than I thought two months ago. For the last three recessions, only a few months passed between the yield curve returning to normal, and a recession striking:

- 1990 Recession: 7 months

- 2001 Recession: 1 month

- 2008 Recession: 3 months

It is difficult for me to believe the economy is going to crash in the next few months. Honestly, if you pointed a gun to my head I would guess the end of 2020/beginning of 2021. I certainly don’t *see* anything that could do it in the next few months. But neither did most folks in 1990, 2001, and 2008 either, so it’s completely possible this time too.

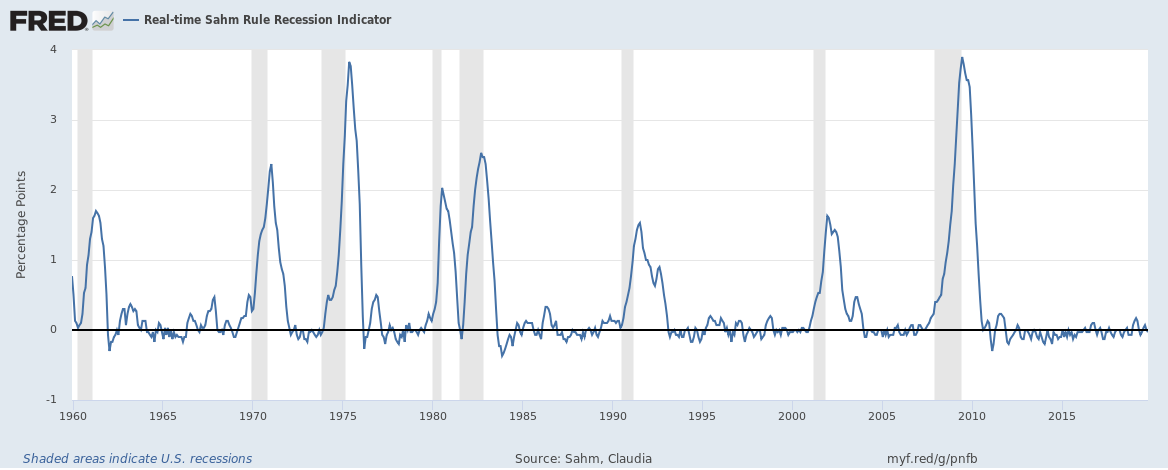

But… Is there any other way of guesstimating recessions? Turns out, now there is! Earlier in 2019, a Federal Reserve economist by the name of Claudia Sahm discovered the “Sahm Rule”, which is garnering a *lot* of attention in economic circles.

The Sahm Rule states that when the three-month average unemployment rate rises half a percentage point above the low of the previous year, the economy has just or is about to enter a recession.

So where does the Sahm rule put us?

Looks like we’re in the clear. Or maybe not…

It turns out, the unemployment low for the year was 3.5% in September 2019. Unemployment has since risen to 3.6% in October. That may merely represent random noise. Or it could be a sign that things are about to go south. Using Sahm’s rule, if unemployment reaches 4% in the next few months, something wicked this way comes…

I strongly recommend folks pay attention to unemployment numbers going forward. If unemployment heads the wrong way a second time, it’s time to at least contemplate scrambling for the exits.

Also, watch how Wall Street behaves. You can bet that every firm on Wall Street worth its salt is aware of the Sahm rule and is watching it like a hawk. Wall Street usually has an accurate estimate of unemployment before the government releases the official numbers. If they determine Sahm’s rule is pointing towards a recession, they may run for the exits simultaneously, which is likely to cause asset prices to plunge dramatically, and may be sufficient to kick-start a market crash.

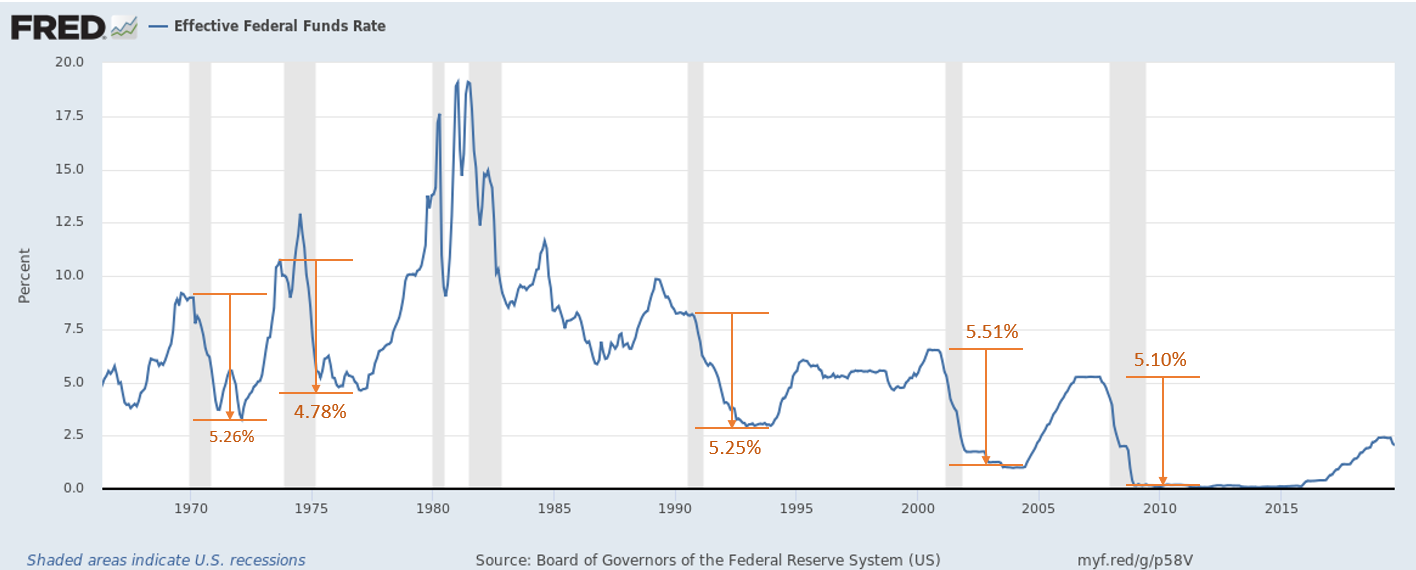

And as for #4, we know that the Fed is nearly out of monetary ammo. Except for the recessions in the early 80’s (which were artificially created by the Fed to get 70’s inflation under control), the Fed normally drops their rate by ~5% after a crash to help get the economy moving again. But they *can’t* do that when the Fed rate is only 1.8%.

And the Trump tax cuts for billionaires increased the deficit by over $1 trillion, limiting our ability to use fiscal stimulus when a recession hits. So government’s ability to pull us out of the fire is going to be a lot more constrained this time than it was in 2008.

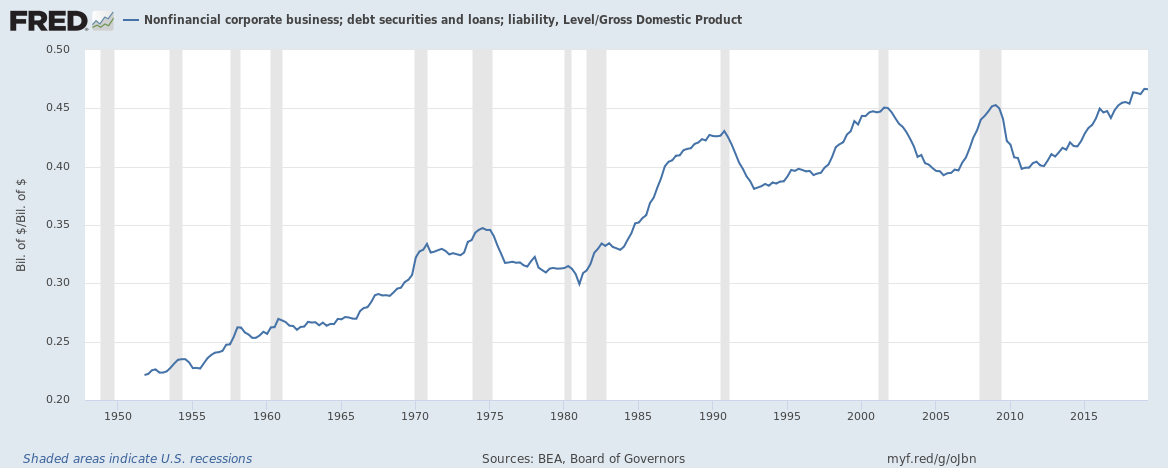

But corporations can also take advantage of crashes to hire new employees and extend into new markets. Will they help save us this time? Unfortunately, probably not.

Instead of learning their lesson in 2008, corporations have piled on more debt than ever. Currently corporate debt is 46.6% of US GDP, an all-time high.

But worse, they *didn’t* use this debt to generate economic value by investing in new products or growing their business. Instead, they largely used it to finance stock buybacks, which made current stockholders (and the CEO’s running the businesses) quite wealthy. CEO departures are on pace for a record year, likely because they’re trying to get out of Dodge while the getting’s good.

The consequence of the enormous debt overhang and failure to invest in long-term economic growth are likely to hamstring companies once a recession hits. You may have read stories about how “leveraged buyout firms” extract the equity of a company, leaving behind a husk that quite often fails due to the burden of debt placed on it.

Instead of a leveraged buyout firm doing it to a single company, CEO’s and executives around the country have done that to a significant number of *their own companies*. Not only are companies not going to be able to help save the economy, a surprising number of them are likely to fail when a recession hits.

In summary, we know that the asset bubble is *really* big, even bigger than the Great Recession bubble. Something is likely to happen in the next year. And our ability to get back to normal is crippled compared to last time.

2020 is looking to be a *mighty* interesting year… Better buckle your seat belts.