Republicans and Democrats constantly argue about how the other side is going to explode the country’s debt. Let’s examine the historical data and see who’s been telling the truth (or more realistically, who’s lying less).

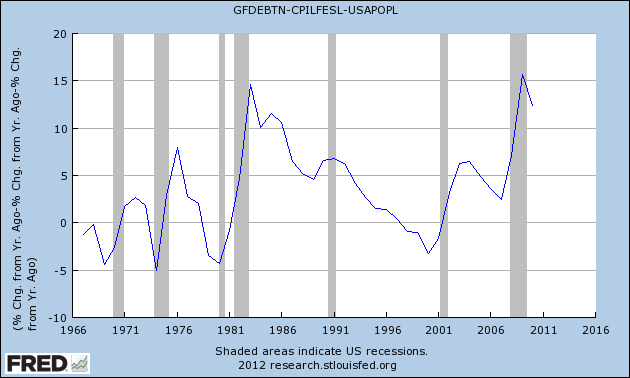

Here is a graph of the growth rate in real per-capita Federal debt (ie, how fast your own personal slice of the Federal debt pie is growing every year) in percent since 1967:

The raw data for this graph is available at FRED by clicking here.

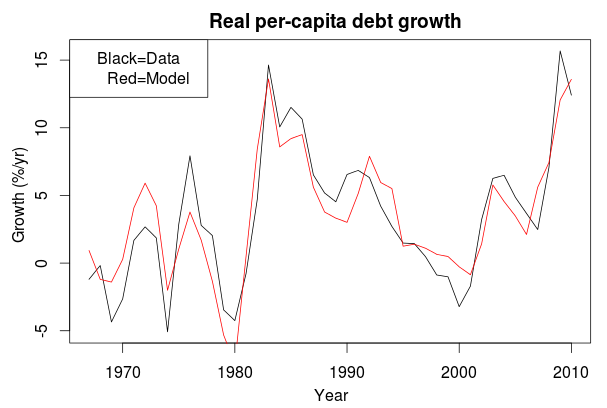

I did a regression assuming the debt is partly based on political factors (which party the president belongs to, and which parties controlled the House and Senate), and economic factors (the Mankiw rule uses inflation and unemployment to predict the Fed Rate, which is a useful measure of how healthy the economy is).

Estimate Std. Error t value Pr(>|t|) (Intercept) 6.68666 0.82734 8.082 7.36e-10 *** President_Dem -1.62684 0.74319 -2.189 0.03465 * Senate_Dem -2.82414 0.91880 -3.074 0.00385 ** House_Dem 6.01083 1.00856 5.960 5.89e-07 *** Mankiw -0.83762 0.07538 -11.111 1.19e-13 *** Multiple R-squared: 0.8057, Adjusted R-squared: 0.7858

And here’s a graph so you can see that this model does a fairly good job of describing what actually happened:

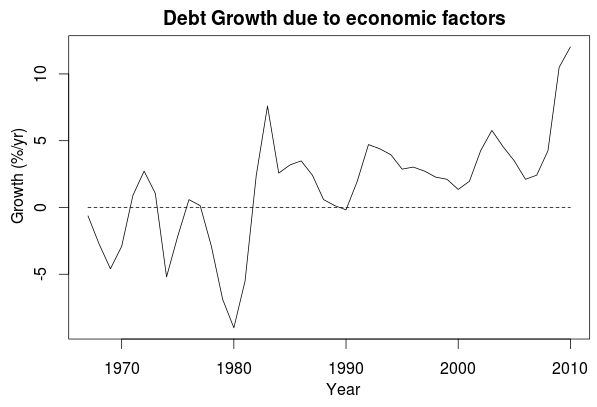

Here’s the debt growth that strictly due to economic factors:

Before 1980, the average debt growth due to economic conditions seesawed below 0%, which is good. Afterwards though, it started on a slow, ugly upward trend. I am uncertain of why, though it may reflect slowing productivity growth, growing income inequality, or demographics shifts increasing entitlement outlays (or it may be something else altogether).

Before 1980, the average debt growth due to economic conditions seesawed below 0%, which is good. Afterwards though, it started on a slow, ugly upward trend. I am uncertain of why, though it may reflect slowing productivity growth, growing income inequality, or demographics shifts increasing entitlement outlays (or it may be something else altogether).

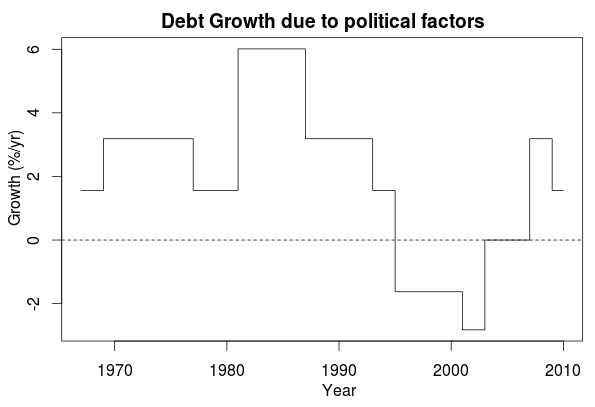

Now let’s see which political party has been better at controlling debt:

The answer is “neither”, though Clinton and the Republican House did a much better job, and Reagan and the Democratic House did a much worse.

Here’s how each possible combination of party affects the debt growth (from best to worst):

President Senate House Debt Growth D D R -4.5% <- Where we are today R D R -2.8% D R R -1.6% R R R 0.0% D D D 1.6% R D D 3.2% D R D 4.4% R R D 6.0%

I notice some interesting things:

- The optimal outcome for keeping the Federal debt down is to have a Democratic President, a Democrat-controlled Senate, and a Republican-controlled House, which is what we actually have today. The jump in Federal debt in recent years is due to economic conditions, not the President.

- Having a Democrat for President reduces the growth in the Federal debt by 1.63% over having a Republican President.

- Having the Senate controlled by Democrats also yields fiscal prudence, shaving 2.82% off the growth rate compared to Republicans.

- On the other hand, you want Republicans running the House, as they subtract 6.01% off the growth rate.

- The Constitution requires all revenue bills to originate in the House, so I find it noteworthy that having a Republican-controlled House *always* yields superior debt control than having a Democrat-controlled House, but the very best results are only achieved when they have to compromise with a Democratic Senate.

So what are the likely outcomes of the 2012 election? Intrade says that Obama is likely to keep the Presidency, the Republicans are likely to keep control of the House, but the Senate is still in play. My numbers suggest that if Republicans capture the Senate, it will increase the growth in Federal debt by (-4.5% - (-1.8%)) = 2.9%. The average year-to-year change in the growth rate is only 2.8%, so an additional 2.9% swing in a year is huge.

The Republicrats have failed “US”. A commodity currency would control the imaginary dollars from being spent and the Federal Reserve from doing the QE twist.