You may have heard people complain about “income inequality” and how it is negatively impacting our country. Here’s a little math to help you understand why it really is a serious problem, and how it’s affecting you personally (spoiler: it’s costing you a *LOT* of money).

In 2017, the United State’s GDP (how much the country earned) was $19.965 trillion, and there were 206.3 million working-age people. So the average earnings per worker is:

$19.965 trillion / 206.3 million people = $96,777 per worker

For the average worker working a 40 hour week and getting two weeks vacation, that would work out to $48.39 per hour. That is the *average* salary for an American worker.

So are you making $48.39 an hour? Me either. I have two graduate degrees and 15 years experience managing a supercomputer, and I don’t make that much.

If you click this link, the Wall Street Journal has a tool to allow you to enter your salary and see how your income ranks percent-wise. The values are in 2014 dollars, so you’ll need to divide your current salary by 1.06 to adjust 2018 dollars for inflation.

According to it, I’m in the top 10% of Americans income-wise. So how can I simultaneously A) be in the top 10% of income earners while B) making less than the “average” hourly salary? How can you be far above average one way, and yet below average another way? Because of how incredibly unequal incomes are.

If Bill Gates and 9 homeless people are in a room, “on average” every person in there is worth $9 billion dollars. But “average” doesn’t really help you understand the situation, because the incomes are so highly skewed. What we really have is 1 person with $90 billion and 9 people with pocket lint.

Remember when I said the “average” person made over $48 an hour? Same thing. Instead of a country where everyone earns $48 an hour, we have a country where most folk make $10-20 an hour, and a very tiny proportion are making $200-300 an hour or more. Where the 400 richest Americans have more wealth than the 163 million poorest Americans combined.

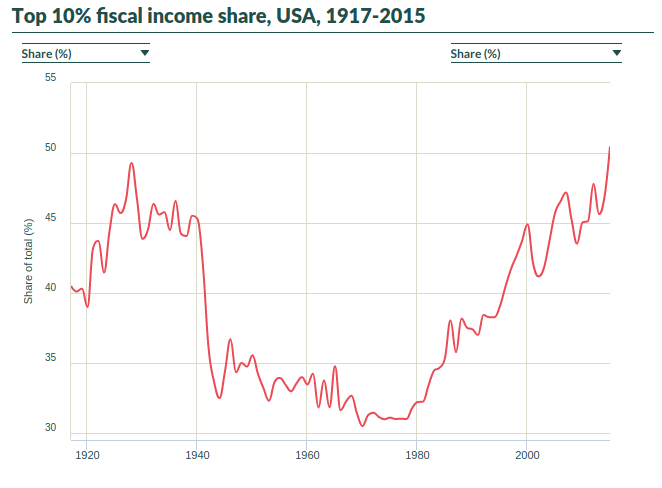

Today the wealthy are taking home a higher share of the country’s income than at any point since the Great Depression (see graph below). Which leaves less money to go around for everyone else. Which is the reason that many poor/middle class families have had to borrow more money or work extra hours in recent years to keep up and still ended up losing their homes in the Great Recession, while the wealthy actually prospered.

*Some* inequality has always existed, and even serves a valuable purpose. If working harder earns you more money, more folks will work harder. But inequality has rapidly grown higher over the past 40+ years, and a lot of poor/middle class folks are working harder than ever, and making *less* money than their parents did, not more, because the wealthy people who own their company will automate their job or ship the job to China if they dare ask for a higher salary.

*Some* inequality has always existed, and even serves a valuable purpose. If working harder earns you more money, more folks will work harder. But inequality has rapidly grown higher over the past 40+ years, and a lot of poor/middle class folks are working harder than ever, and making *less* money than their parents did, not more, because the wealthy people who own their company will automate their job or ship the job to China if they dare ask for a higher salary.

How much is income inequality costing you personally? Math time: In 1970, the bottom 90% of earners shared 68% of US GDP. In 2012, the bottom 90%’s share had shrunk to 49% of US GDP. Let’s use our numbers from earlier:

$19.965 trillion * (0.68 – 0.49) / 206.3 million = $18,387 richer, per worker, per year.

Let’s say that again so it sinks in: If we restored income inequality to 1970’s levels, the average worker in the bottom 90% would earn $18,387 more this year. And more the next year, and the year after, and so on.

Get the picture? That’s a *lot* of money. And it is being diverted to the people who need it the *least*, not the people who need it the *most*.

The wealthy have spent the past few decades bribing politicians to game the system ever further in their favor at your cost. I’m not trying to claim the rich are all mustache-twirling villains (though some indeed are!) Merely that they have spent decades doing what is in their best financial interest: paying politicians to change laws to help them become ever richer.

The problem is, “political financial engineering” doesn’t *create* wealth. It merely *shifts* wealth away from the poor/middle class and steers it to the rich. And consequently this generation will be the first generation of Americans to have a *lower* standard of living than their parents. The bottom 90% are left having to figure out how to get a car, buy a home, pay for college, or how to retire using the “leftovers” of our nation’s wealth. But we *can* change it.

So it’s time that the poor and middle class start doing what’s in *their* best interest and putting that $18,000 per year back in their own pocket. Where do we start? A good first step would be raising taxes on the wealthy (instead of cutting their taxes and making our children pay for it like we’ve been doing…), and using the proceeds to a) pay off the country’s debt, b) pay for infrastructure like roads and bridges, c) roll out a nationwide fiber broadband network, d) increased spending on education, particularly Pre-K and community college, e) funding universal healthcare, and f) increased funding on science research.