Note: I actually wrote this May 11, but neglected to publish it because I was thinking about adding a few more things and eventually got side-tracked by some research I was doing on Cheatham County. Unfortunately, my predictions seem to be panning out. If only I understood women as well…

Since I began writing this, CNN came out with their “Fear and Greed index”, which does what I was trying to do, only much better, so give them a look.

—

My dad has been hectoring me to predict the mood of the market so he can rebalance his retirement portfolio. After doing some research, I’m not an optimist about the next 6 months.

Bad sign #1: Personal income growth is slowing

The ECRI reports that the growth rate in personal income (the blue line) has slowed to 0%. The income growth rate is very strongly to economic conditions. You can see that a sharp downturn in the growth rate often presages a recession.

The ECRI reports that the growth rate in personal income (the blue line) has slowed to 0%. The income growth rate is very strongly to economic conditions. You can see that a sharp downturn in the growth rate often presages a recession.

Bad sign #2: Stock sales by insiders near decade peak

CNN reports that stock sales by insiders (CEO’s and directors at companies) are the highest in 10 years. While CEO’s are still publicly forecasting good times, their stock sales tell a different story. Why sell your stock today, if you honestly believed your company’s stock was going to be worth more in 6 months?

Bad sign #3: Price of oil drops 10% in a week

The price of oil may be going down because the market believes the chance of armed conflict with Iran is diminishing. That would be good, because lower gas prices would help stimulate the economy.

Unfortunately, what I’ve read is that the price dropped because of decreased demand due to slowing economies in China, India, and Europe.

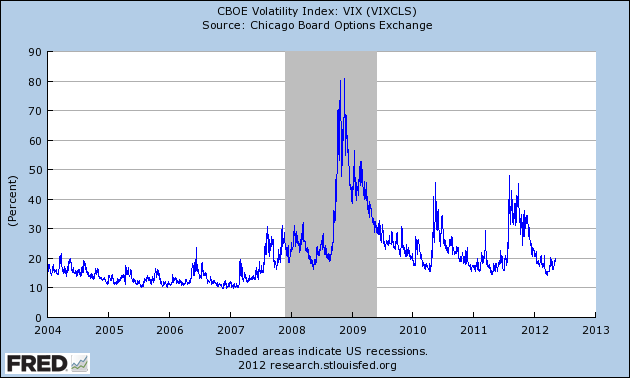

(Probably) Bad sign #4: The VIX index is rising

The VIX index measures volatility in the market. Peaks in the VIX are usually correlated with market drops. You can see it reached “bottom” in 2012, and is showing a slight uptrend towards the end. That is signaling increased uncertainty about the immediate future.

The VIX index measures volatility in the market. Peaks in the VIX are usually correlated with market drops. You can see it reached “bottom” in 2012, and is showing a slight uptrend towards the end. That is signaling increased uncertainty about the immediate future.